What is owner financing & how does owner financing work?

In this InvestorWize article I will explain to you the details on what is owner financing, how owner financing works and how you can become the bank if you need to sell your house and cannot seem to sell your home any other way! Owner financing is usually called seller financing. Both are fine so if I use the phrase interchangeably just remember they are both the same thing. The first thing you need to understand is that owner financing is very easy to do. It doesn’t require a lot of paperwork and anyone can do it. You can use this technique to help sell your home fast even if the market is not going so well in your neighborhood or even if you want to make a nice long term income from the property if you are moving or relocating. In any case here is how owner financing can work for you!

What is owner financing?

Owner financing is when the seller of a property decides to sell their home by offering a loan to the buyer. Basically this means that the buyer is indebted to the seller or owes the seller for the amount agreed upon for the purchase price of the house. Just like a bank does when it finances your purchase with a mortgage, owner financing allows you the homeowner to become the bank and make a small profit over time. Whats even better with this selling option is that you are free to do what ever you want because you are the bank. You can be flexible enough to allow pretty much anyone to purchase your home.

How does owner financing work?

So how does owner financing work? Owner financing works by creating a win-win scenario between the buyer and the seller. If the seller needs to sell their house and cannot do so in a reasonable amount of time its beneficial to offer seller financing as a fast way to offload the property while making a good return on their investment. Some buyers are not in a a situation credit wise to get approved for a home. They may have the income and may pay all their payments on time in their existing residence and still may not be approved. This is where seller financing helps both the buyer and the seller. The buyer will not need to qualify for a loan and the seller gets to sell the property while keeping the title in their names. If the buyer were to default on payments the house will still belong to the seller and they can just do it all over again.

When to decide to use owner financing.

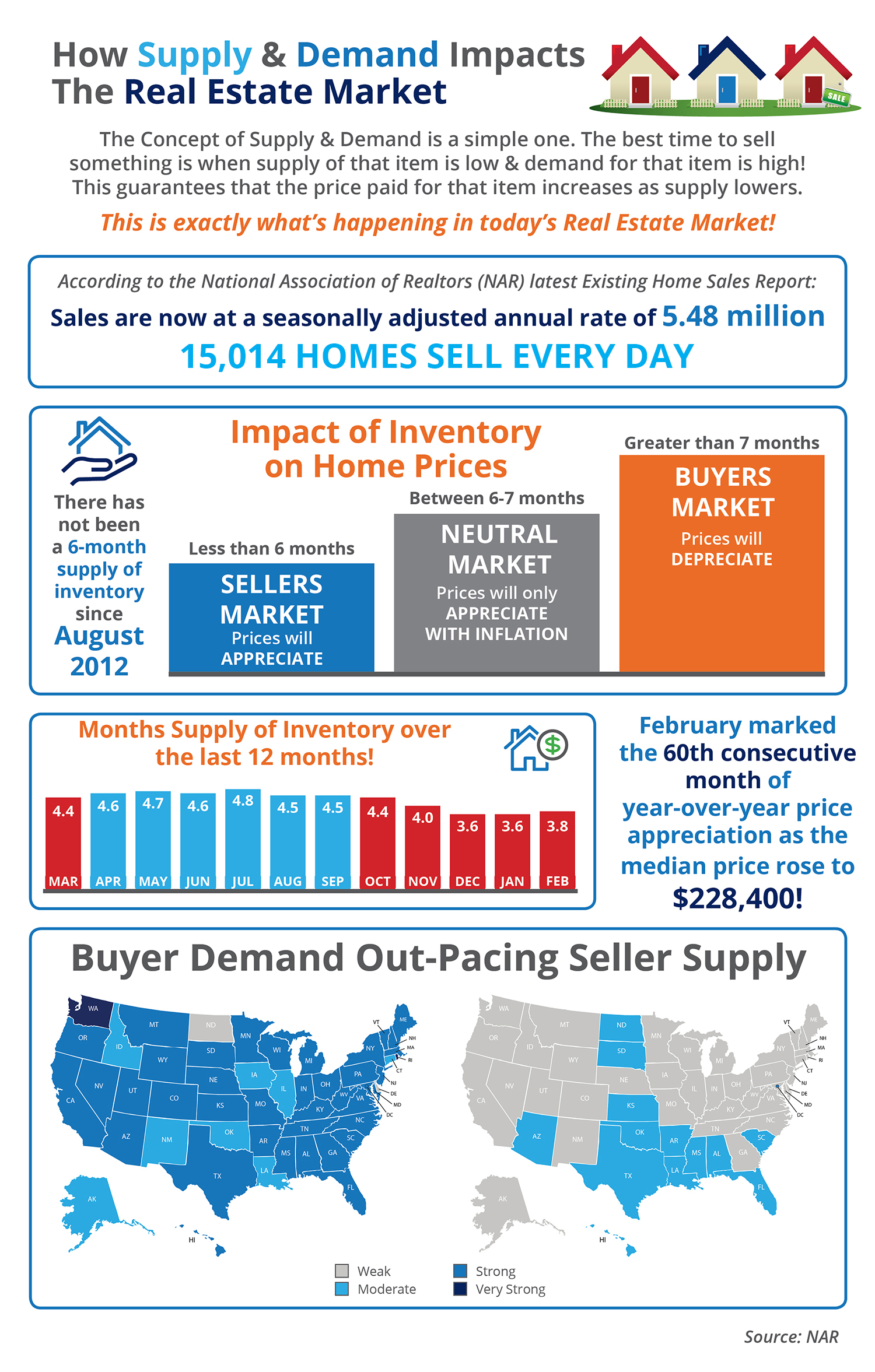

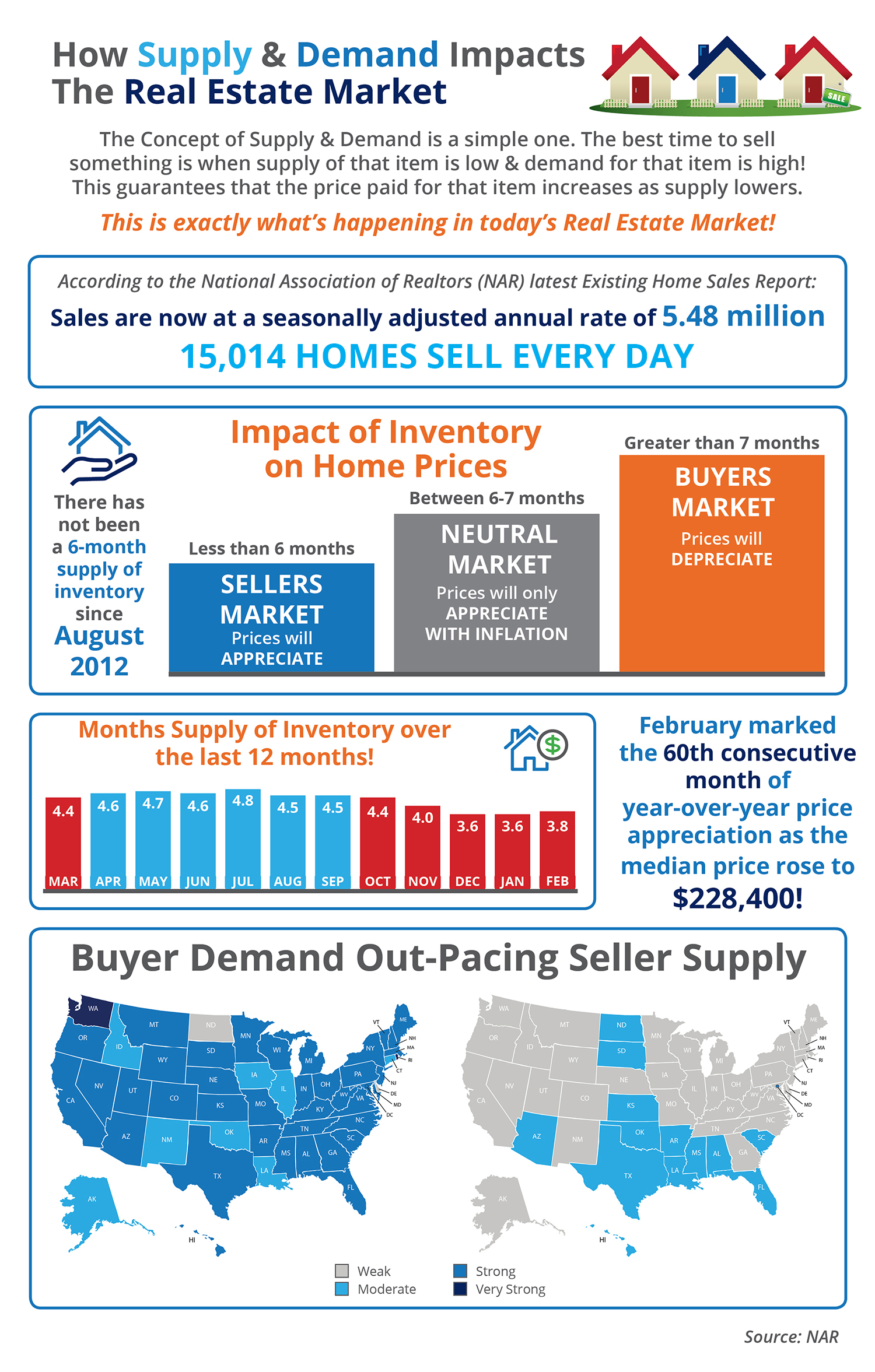

The best time to use seller financing is when there is a buyers market. A buyers market usually occurs when there more houses on the market then there are buyers looking to buy homes. It as simple as supply and demand. More supply of houses for sale and less demand from buyers = “A Buyers Market”. Vice versa, if there are less houses on the market and more buyers looking to buy homes then it becomes a sellers market. In a sellers market it should be pretty easy to sell your home. On top of that you may even get more money for it because your property is highly in demand! However if it is a buyers market this owner financing may be just right for you if you need to make that stubborn sale happen.

Pros & Cons of Owner Financing

Pros for buyers:

- Really Fast to Close – The owner are the one who approves the loan so no waiting on bank approvals.

- Save money on closing costs– There are no appraisal costs bank fees or inspections that are needed.

- No Bank Approvals – Buyers who do not qualify for a loan can easily buy using seller financing.

- Lower down-payments or no down-payments. Buyers don’t need to worry about a down payment if the seller doe no require any. In the case the seller does need a down payment that amount is negotiable and the seller

Pros for sellers:

- No Repairs – Sellers can sell their homes as-is.

- Keep the title – If the buyer does not pay or defaults you get to keep the home, the down payment and money received up to that date. Your security is the home itself.

- Best investment alternative – Potential for the seller to make long term income even more as supposed to selling it right away.

- Option to cash out. Sellers can still sell the note to another investor and get most or all of their money out.

- Fast Sale – Make it easier to sell the property even if it is in a buyers market.

Cons Of Owner Financing

Owner financing has a lot of perks but lets not forget to mention the cons. In any choice you make there will always be cons so lets review a few of them below.

Cons for buyers:

- Larger Down-payments – Some sellers require a larger down payment which may make buying the home impossible

- Higher interest – Expect to pay more interest when going the owner financing route. Sellers will want to make some profit expecially if there is a mortgage already on the house. If there is than expect to pay higher interest and fess to cover such costs.

- Seller Approval – Buyers will need to be able to convince the seller that they can buy the house and can handle the owner financed mortgage.

- Due on Sale clause – The original lender of the property can chose to call the loan due if they find out that the property has been sold through seller financing. This can happen if there is a Due on Sale clause inside of the mortgage contracts the seller signed when first buying the house. Lenders can call the loan due and ask that the full balance be paid so its best to get them to agree to this before selling the house via owner financing or the buyer will have to refinance the loan. There are other ways out of this but ill leave it for another topic.

- Balloon payments – Most of the time sellers will have a balloon payment due. This means that the full payment of the loan will need to be paid off by a particular date.

Cons for sellers:

- Buyer can stop making payments leaving the owner to try to rent or resell the house. This can leave the seller in an awkward position of having to pay for their existing residence and the home. On top of this the seller may have to pay for any repair costs associated with owning the house so they can re-rent it or resell it again.

- Dodd-Frank Act (see Dodd-Frank Act and how does it affect me?) – there are now new rules to owner seller financing: now you may have to get a Loan Originator balloon payments may not be an option, and you might have to involve a Mortgage Loan Originator, depending on the number of properties you owner-finance each year.

Dodd-Frank Act

The Dodd-Frank states “any person who for direct or indirect compensation or gain or in the expectation of direct or indirect compensation or gain takes a residential mortgage loan application or offers or negotiates terms of a residential mortgage loan.” see the Dodd Frank Act Washington State Legislature for more details. To make this even more complex there are different federal and state rules that may apply to your locale that is very enigmatic or difficult to understand . The mortgage loan originator rules state the following

Who is exempt from licensing as a mortgage loan originator under this act?

The following are exempt from licensing as a mortgage loan originator:

(1) Registered mortgage loan originators or any individual required to be registered while employed by a covered financial institution as defined in regulation G, 12 C.F.R. Sec. 1007.102;

(2) Any individual who offers or negotiates terms of a residential mortgage loan with or on behalf of an immediate family member of the individual;

(3) Any individual who offers or negotiates terms of a residential mortgage loan secured by a dwelling that served as the individual’s residence;

(4) A Washington licensed attorney who negotiates the terms of a residential mortgage loan on behalf of a client as an ancillary matter to the attorney’s representation of the client, unless the attorney is compensated by a lender, a mortgage broker, or other mortgage loan originator or by any agent of such lender, mortgage broker, or other mortgage loan originator;

(5) Individuals who do not take residential mortgage loan applications or negotiate the terms of residential mortgage loans for compensation or gain or in the expectation of compensation or gain; and

(6)(a) An employee of a bona fide nonprofit organization who acts as a loan originator only with respect to his or her work duties to the bona fide nonprofit organization, and who acts as a loan originator only with respect to residential mortgage loans with terms that are favorable to the borrower.

(b) Terms favorable to the borrower are terms consistent with loan origination in a public or charitable context, rather than a commercial context.

(7) Individuals employed by a licensed residential mortgage loan servicing company engaging in activities related to servicing, unless licensing is required by federal law or regulation.

How to Sell Your house with Owner Financing

Here is a really helpful article on how to sell your house with owner financing. Hopefully this will help you when marketing it out to buyers and letting them know. I will be giving a more in-debt article shortly on how you can do this legally. So in the meantime so stay tuned for more.